Completely eliminating the risk of fraud isn’t possible, regardless of which measures a company employs. However, intentionally evaluating accounting processes, procedures, and other areas can help reduce exposure, providing business owners greater peace of mind.

Identifying and closing operational gaps that employees or people outside the company could use to commit fraud or theft isn’t foolproof, but it can make it significantly more difficult to perpetrate the fraud—enough to look for easier alternatives elsewhere.

Fraud and theft may make headlines, but many transportation and logistics companies do greater damage to their long-term financial health by neglecting everyday issues that can result in outdated policies, inadequate controls, and operational inefficiencies.

Systems Control and Operations Risk Evaluation (SCORE!)

SCORE! is a diagnostic tool for your systems, processes, and efficiencies. A SCORE! engagement is customizable to different settings and circumstances.

Assess Organization Processes

The tool can focus on specific operational areas, such as revenue, cash receipting, or disbursements. You select for analysis only those processes that are most relevant to your organization.

SCORE! can help identify and avoid costly errors due to lack of attention and improper application of processes or procedures. It can offer an economical and flexible approach to evaluating business processes, led by a group of consultants and CPAs who are knowledgeable about your business.

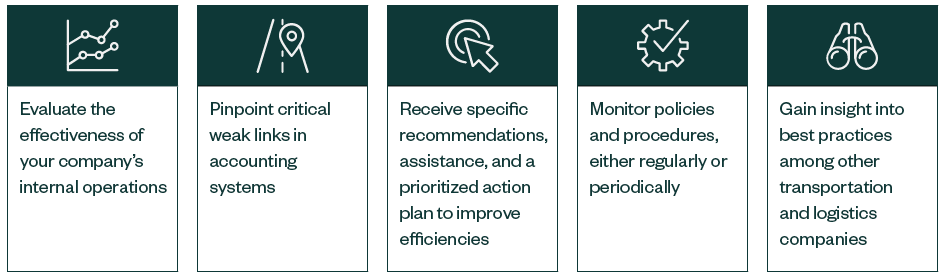

Five Benefits of Evaluating Processes and Procedures

There are five distinct benefits to evaluating business processes and procedures to help your organization reduce risk.

SCORE! Benefits

How Does SCORE! Work?

A SCORE! consulting engagement would evaluate specific control cycles of your company. The resulting practical report outlines selected elements of your current control structure and compares it to a best practice.

Process Overview

Select the processes that are most relevant to your business for analysis, such as:

- Accounts receivable

- Accounts payable

- Cash controls and management

- Revenue recognition

- State and local taxes

- Other liabilities

Our professionals visit your organization for two to five days, depending on the number of SCORE! processes you select, to perform diagnostic procedures and tests.

Using tools developed by Moss Adams, we assess the operational processes you request and provide a practical comprehensive written report within one to two weeks. This report is an objective, comprehensive assessment of your organization’s operations in predetermined areas and includes recommendations for changes and improvement.

Engagement Approach

A SCORE! engagement is based on the level of detail you desire in the report. The benefit of this type of project is the ability to modify the engagement to fit your unique needs.

The following is an outline of the general approach.

Initial Discussion

The initial discussion takes place in a meeting with the board or management to discuss the scope and level of detail that’s desired in your SCORE! engagement. From this discussion, the board will determine what they want to achieve.

Interviews and Diagnostics

Draft procedures after determining the scope of the SCORE! engagement.

Procedures could include the following:

- Develop inquiries to be addressed to all staff involved in the process

- Document responses and assess them for conformity with existing policies

- Perform limited walk-throughs of transactions to verify if processes function as they’re currently documented

- Inquire about existing systems and processes to determine where they don’t function, as documented by your policies and procedures; if they function in accordance with the written procedures, assess how they can be better implemented

Analysis of Opportunities

Discuss initial findings with management and assess whether expansion or reduction of the originally determined procedures is necessary.

Report

Complete inquiries and walk-throughs, then draft a report to management with recommendations for improvement.

Immediately following a SCORE! engagement, we’ll meet with you and your senior management to discuss the findings. You’ll receive a written report of identified findings categorized as high or low risk to help the board prioritize resolutions and corresponding recommendations that can be implemented by your company.

Reports are designed to translate accounting system challenges into easily understandable solutions that help address the problems unique to your organization. It’s also a cost-effective method for providing the results companies most desire.

Example Findings

The following are examples of findings in four areas that a SCORE! engagement report may include.

Billing

- Reconciliation of dispatched orders in system to billed orders didn’t appear to occur. Billings are initiated by driver slips being returned, resulting in risk of untimely billing to customer or missed billings.

- Outliers generally are caused by chassis charges being slow to receive from the port

Disbursements

- A disbursement selection was made to an incorrect vendor

- One individual is an authorized check signer with full access to QuickBooks and performs bank reconciling functions

- A duplicate disbursement was made to a vendor

Collections

- Billing adjustments are performed at the discretion of one individual with no oversight or monitoring of adjustments made

- Monitoring of cash suspense account detail wasn’t done by an appropriate level of management

Shared Login Credentials

- Multiple users share the same login to access online banking and QuickBooks

- On the main computer at office location one, the username and password were saved within the browser to log in to online banking

- Accounting personnel at location one log in to QuickBooks with the same username and password

We’re Here to Help

If you would like to learn more about a SCORE! engagement and how it could benefit your company, please contact your Moss Adams professional. You can also visit our Transportation & Logistics Practice for additional resources.